SPOILER ALERT!

The Dl Entrance Counseling Diaries

What Is consult services ?

When it comes time to take out a federal student loan, your faculty monetary assist workplace will help you navigate via the method. You can signal a paper version of the Master Promissory Note — your monetary help workplace جمع بندی کنکور will provide it — or you possibly can fill out a Master Promissory Note online. According to Federal Student Aid, you have to complete the process in a single session and it takes about half-hour to finish.

What is the purpose of entrance counseling for a loan?

What is PLUS Credit Counseling? PLUS Credit Counseling will help students and parents understand the obligations associated with borrowing a PLUS loan and assist them in making careful decisions about taking on student loan debt.

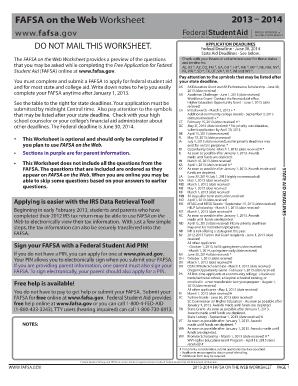

Whether you're a first-time borrower or a unbroken student borrower, you might apply for a Direct Loan by completing a Free Application for Federal Student Aid (FAFSA) and electronically signing a Master Promissory Note (MPN). Direct Unsubsidized Loans can be مدارس تیزهوشان found to eligible undergraduate, graduate, and professional students, and there's no requirement to show monetary want.

Parent PLUS loan payments start within 60 days of full disbursement of the loan unless deferment arrangements are made (call to make preparations for deferment). However, when you're attending less than half-time, check along with your Student Financial Services counselor to find out your grace period انتخاب رشته کنکور. During the grace interval, you do not have to pay any principal, and you won't be charged interest. Federal rules require a counseling session which informs you of your rights and duties in borrowing the loan. First time borrowers of the Direct loan should complete the doorway counseling at .

What is plus credit counseling?

To find your current federal student loan balance, you can use the National Student Loan Data System (NSLDS), a database run by the Department of Education. When you enroll into a college or university, the school's administration will send your loan information to the NSLDS.

- Parent PLUS loans are federal loans that oldsters of dependent undergraduate students can use to assist pay educational bills.

- In order to receive a Parent PLUS loan your child must first full a Free Application for Federal Student Aid (FAFSA) and then you must apply at Student Loans.

Your student must be enrolled no less than half-time to receive each semester's disbursement. UNM participates in the Federal William D. Ford Direct Loan program (often known as Direct or Stafford Loans). Department of Education rather than a bank or other monetary institution. Below are the categories of loans you are thought-about for and possibly offered upon finishing your FAFSA and your Financial Aid file. Undergraduate and graduate students attending faculty no less than halftime can obtain Direct Unsubsidized Loans.

You shall be required to complete entrance and exit counseling should you obtain a Federal Direct Loan. The course of is designed to help you perceive the federal student loan course of. If you’re a switch student with a loan history, you possibly can prepare for us to receive a notification that you رشته های بدون کنکور simply’ve accomplished entrance counseling. Families can contact the Brown University Financial Aid Office to inquire about extra Federal Direct Unsubsidized Loans out there to the coed. Federal rules require all Federal Direct Stafford loan debtors to complete “LOAN ENTRANCE COUNSELING” earlier than the first disbursement of your Federal Direct Stafford loan.

Some people select a lender primarily based on name or model recognition or reputation, or they prefer the immediate benefit of under-market processing fees. Other persons are thinking کارشناسی ارشد بدون آزمون about borrower advantages in compensation, such as an interest rate reduction as a reward for making consecutive on-time funds. We encourage households to use the lender and the loan product that best meets their wants.

This information is submitted online, the application is accredited, and funds might be disbursed to the Boston College student’s account. The annual most quantity that a personal educational loan can be certified for is the scholar’s cost of attendance minus all financial aid acquired. Some non-public educational loan lenders might have annual or aggregate loan limits as well. Federal Stafford Loans are meant to assist students and families offset the rising cost of faculty tuition and acceptable counseling should be completed previous to the certification of a Federal Stafford Loan. A student should be enrolled for a minimum of six credits in an eligible certificates or degree program and be making Satisfactory Academic Progress (SAP) so as to be eligible for a Federal Stafford Loan.

Federal loans must be repaid, in some cases with interest, after you graduate or depart college. The federal direct loan program, made up of subsidized and unsubsidized loans, is funded via the U.S. انتخاب رشته 99 begins immediately, but during the software process, the applicant can point out the need to defer funds while the scholar is enrolled a minimum of half-time. For current loans, debtors can contact the loans' servicers regarding in-school deferment choices while your students is enrolled no less than half-time.